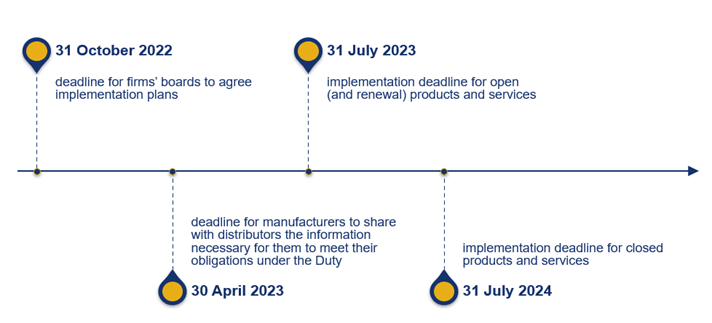

After months of anticipation, the FCA has published its final rules on the new Consumer Duty (PS22/9), heralding a major shift in the delivery of UK financial services. Whilst the implementation deadline has been extended by three months to 31 July 2023 (31 July 2024 for closed products and services), firms now have just under a year before they need to comply with the requirements, some of which have changed from the draft rules consulted on.

What is the Consumer Duty?

As a reminder, the Consumer Duty is a package of measures which is intended to set higher expectations for the standard of care that firms provide to consumers. It comprises three key elements:

- A new Consumer Principle (Principle 12) will require firms to "act to deliver good outcomes for retail customers". Where the Duty applies, Principle 12 will replace Principles 6 and 7 as it sets a higher and more exacting standard of conduct compared to what the existing Principles would have otherwise required

- Cross-cutting rules to help develop the standards of conduct expected under Principle 12

- Rules and guidance relating to four outcomes that the FCA wants to see under the Consumer Duty.

The Consumer Duty will apply to new and existing financial products and services that are open for sale or renewal from 31 July 2023, and for financial products and services held in closed books from 31 July 2024. The Consumer Duty will not have retrospective effect and actions or omissions occurring before the Duty enters force will continue to be assessed in line with the rules in force at the relevant time.

In terms of scope, the FCA has maintained its proposal to apply the Consumer Duty in line with the approach of existing sourcebooks in the FCA Handbook, including to SMEs. Accordingly, where FCA Rules currently cover a firm's relationships with an SME customer, the Consumer Duty will equally also apply to that financial product or service.

The Consumer Duty will also apply to:

- Dealings with high-net worth customers (and this includes the processes applied by firms to determine a client’s status as a professional client)

- Ancillary activities, including unregulated activities, which are necessary for the completion of a regulated activity – this is despite concerns from industry respondents that this proposal lacked certainty and could extend the scope too broadly

- All payments and e-money firms (even though the distribution chains may look different in that sector)

- Beneficiaries of trust based pension schemes (the definition of "retail customer" has been extended to include these individuals).

The FCA has published finalised guidance (FG22/5) alongside its final rules which will help firms in interpreting the rules and their new obligations.

What's changed since the consultations?

Most firms have already kicked off their implementation projects and so will be familiar with the content of the FCA's proposals set out in CP21/13 and CP21/36. However, the final rules and guidance contain a number of changes to these proposals that firms will need to incorporate into their planning. These include:

Cross-cutting rules

Whilst the overarching cross-cutting rules remain largely as drafted, the FCA has confirmed that firms are required to "avoid causing foreseeable harm to customers". This wording was updated to "avoid foreseeable harm" in CP21/36 in response to industry concerns but the FCA has reverted to its original wording.

The FCA’s finalised guidance provides a list of examples of foreseeable harms and also contains examples of conduct that is unlikely to meet the cross-cutting standards more generally.

Four outcomes

The four outcomes have been updated since the draft rules were published and now comprise product and services, price and value, consumer understanding and consumer support outcomes.

- Products and services – the final rules confirm that firms will not be subject to both the existing PROD rules and the new rules in PRIN 2A.3. Firms that comply with PROD will be compliant with this outcome, but where products are not caught by PROD then firms must comply with the new PRIN requirements

- Price and value – new guidance in PRIN sets out a list of factors for product manufacturers to consider when assessing whether a financial product or service is providing fair value. The FCA has also confirmed that firms do not need to conduct a value assessment for products or services that do not have any financial or non-financial cost to the consumer (eg free in-credit current accounts or free debt advice services). The final rules clarify that firms are responsible only for prices that they control, and are not required to repeat or challenge other firm’s value assessments

- Consumer understanding – the FCA has replaced the notion of the "average retail customer" with "retail customers in the target market", thereby requiring firms to ensure that a communication is likely to be understood by those customers actually intended to receive it. The testing requirement has also been amended, such that testing is now to be conducted “where appropriate” to identify if firms' communications are supporting good outcomes for retail customers

- Consumer support – there is now a requirement for a firm to ensure that it includes “appropriate friction in its customer journeys to mitigate the risk of harm and give retail customers sufficient opportunity to understand and assess their options, including any risks”. However, the FCA’s guidance recognises that some friction points can act as unreasonable barriers and make it more difficult for customers to act in their interest, so firms should apply judgement and distinguish between positive frictions and harmful frictions (like sludge practices) based on the circumstances.

The FCA has also confirmed that the rules on the consumer support outcome do not apply to a firm which is dealing with another firm which is in turn acting on behalf of a consumer. That said, firms are still obliged to deal with “reasonable requests from another firm in an effective way and in good time to enable the other firm to support retail customers”.

Monitoring

Firms are required to monitor outcomes experienced by their customers by regularly reviewing their financial products and services to ensure that they are delivering on the four outcomes.

Although CP21/36 required firms to identify where the outcomes were "worse", the final rules have expanded the scope of this obligation. Firms must now identify whether any group of retail customers is experiencing "different outcomes" compared to another group of customers receiving the same product or service. The FCA also expects firms to become proactive in identifying poor customer outcomes or harm and undertaking root cause analysis to understand the causes for both.

It is worth noting that a firm’s monitoring obligations apply proportionately to its role in a distribution chain. However, even if a firm does not have direct contact with retail customers, the FCA expects it to monitor the outcomes of the service it provides and act reasonably to obtain information about the outcomes experienced by retail customers.

For the FCA's part, it has confirmed that it will measure the success of the Consumer Duty by monitoring key outcomes for consumers both through monitoring firms' MI (discussed below) but also through data like relevant FOS final decisions.

Governance

The final rules set out new requirements for the governance process. The FCA expects there to be a Consumer Duty champion at board level (ideally an iNED) and it also expects firms' boards to sign-off an assessment of the firms’ monitoring and actions at least annually.

Boards should also have agreed their implementation plans and maintain oversight of their delivery by the end of October 2022, and they should be prepared to share such plans, board papers and minutes with the FCA from this point.

Implementation

As mentioned above, implementation of the Consumer Duty will be phased. Firms must apply the new requirements to new and existing products and services that are on sale (or can be renewed) from 31 July 2023, but have until 31 July 2024 to apply the Duty to closed book products and services. The final rules set out the FCA's expectations of firms during the implementation period which also provides a useful roadmap for firms to refer to in their planning. The key dates that firms should be aware of are as follows:

Management information

MI and data play a fundamental role in enabling firms to assess whether their customers are experiencing the four outcomes in accordance with the spirit of the Consumer Duty. The finalised guidance provides a reasonably comprehensive list of potential data sources which firms could use to evaluate their compliance. It is worth noting that the FCA has not at this stage introduced a regular reporting obligation but it will consult on any future proposals to do so.

SMCR

In the consultations, the FCA suggested that delivering good outcomes for retail customers should be supported by individual accountability and personal conduct under the SMCR. The final rules introduce a new individual conduct rule 6 which reflects the new higher standard of the Consumer Duty, in that all conduct rules staff must “act to deliver good outcomes for retail customers”.

Notably, new guidance at COCON 4.2.31 places an obligation on SMF holders to notify the FCA of other firms’ breaches or its own firm’s breaches of Principle 12 or PRIN 2A, if the firm itself does not do so.

Vulnerable customers

The Consumer Duty aims to raise the standard afforded to all consumers, but the FCA urges firms to consider the new rules and guidance alongside its guidance on the fair treatment of vulnerable customers (FG21/1).

As noted above, the FCA has recognised that the use of the term "average customer" could be confusing and instead is requiring firms to consider the needs of customers in their target market, including those with characteristics of vulnerability.

Next steps

Whilst most firms will be well underway with their implementation planning, others will have a lot of work to do before next July. And given that the implementation deadlines are due to start from the end of October, firms should be ramping up their planning to ensure that robust procedures are in place.

If they are not doing so already, firms should be focussing on:

- Conducting a framework review of all financial products and services expected to be available in July 2023 to test their compliance with the Consumer Duty

- Engaging relevant internal stakeholders to ensure that each part of the business understands its obligations and is ready to support the implementation process

- Preparing and fostering a culture within the firm to effectively implement the Consumer Duty

- Preparing and developing channels of communication with other firms involved in the distribution chain to exchange and share information on financial products and services

- Creating and finalising an implementation plan by end-October 2022 for actions that need to be completed by the time when the Consumer Duty takes effect

- Implementing effective project governance to ensure implementation activity is carried out in line with the finalised implementation plan

- Designating a board champion for the Consumer Duty (ideally an iNED)

- Preparing processes and policies to collate relevant data and management information

- Establishing relevant procedures for ongoing monitoring and action plan implementation policies.

The authors would like to thank Harshil Patel for his help in the preparation of this article.

This article is for general information only and reflects the position at the date of publication. It does not constitute legal advice.