Earlier this month, on Wednesday 14 February, if you weren't too distracted opening Valentine's Day cards and gifts, you might have turned on the morning news to hear the main story that "UK inflation stays at 4%". We have now had over two years of high inflation exceeding the Government's target of 2%. The Bank of England have hiked the base rate from 0.1% at the end of 2021 to 5.25% at present in an attempt to dampen the economy and curb inflation to the intended level, but inflation remains twice as high as it should be. The Bank of England's governor, Andrew Bailey, was careful to not put a more positive spin on things when commenting that the latest data "pretty much leaves us where we were" in terms of the fight against high inflation and the potential for reductions in interest rates.

When dealing with statistics, the way figures are presented tells a certain story and, in this case, by viewing the data through a different lens, the inflation situation can appear quite different than at first glance.

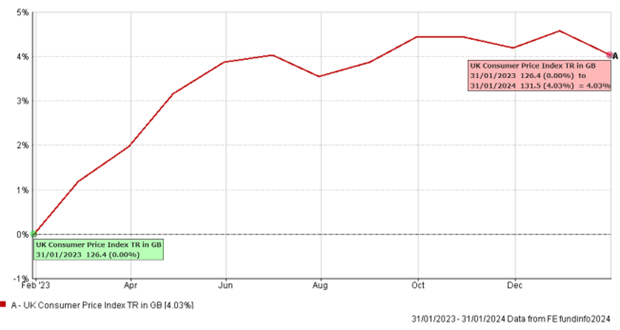

Firstly, it is important to understand how the UK inflation rate is calculated. The inflation rate is based on the increase in the Consumer Price Index (CPI) over the past twelve months. CPI, which is updated monthly, was 126.4 on 31 January 2023 and rose to 131.5 on 31 January 2024; an increase of 4%.

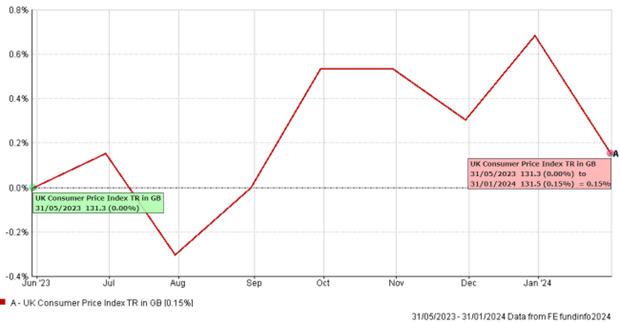

However, when we look more closely at the graph above we see that CPI increased rapidly from February to June 2023, and since then has been largely static. Indeed, over the past eight months CPI has increased by only 0.15%.

So, unless there is a quick uptick in inflation over the next few months, we might see the twelve month inflation figure falling below the Government's 2% target. The news that the energy price cap will fall in April 2024 to its lowest level in two years only makes this outcome more likely. With all of this in mind, might the Bank of England look to begin reducing interest rates sooner than expected? They clearly have a difficult decision to make when they next meet on 21 March 2024.

What could this mean for investors?

Cash has been an attractive proposition for investors over the last couple of years, providing decent returns through historically high interest rates and with minimal risk attached. However, if interest rates are reduced those investors who have been sitting on increased cash holdings may need to consider a more diversified investment approach to achieve improved returns over the long term.

At Womble Bond Dickinson Wealth, we have a renowned team of financial advisors who are experienced in constructing bespoke portfolios for our clients, which are diversified across a range of asset classes such as equities, bonds, alternatives and property, as well as cash. However, we provide a lot more than just investment advice, and add further value for our clients through tax and estate planning for example. If you would like to discuss investments and your wider planning needs with a member of our team, we would be pleased to hear from you.

This article, written by Womble Bond Dickinson Wealth Limited which is regulated by the Financial Conduct Authority, is provided for general information only and reflects the relevant rules at the time of publication in February 2024. This article does not constitute any professional advice and so should not be relied on for any purposes. You should consult a suitably qualified professional adviser for further assistance. Please note that past investment performance is not a guide to future performance. The value of an investment and any income from it may go down as well as up over time and investors may not get back the amount originally invested. Care should be taken to ensure that any financial plan and its underlying components are regularly reviewed to take account of any changes such as personal situation, objectives, tax rates and the variabilities of investment performance and associated charges over time.