The South Carolina Department of Revenue has released the 2020 county tier rankings for all South Carolina counties. The rankings are reassessed each year and are determined in part by per capita income and unemployment rate data received from the South Carolina Department of Employment and Workforce and the United States Department of Commerce.

A county’s tier ranking affects certain economic development incentives that a project located in that county can receive, such as the amount of job tax credits (JTCs) for new, full-time jobs created by the project. The “basic” JTC amounts – before giving effect to any enhancements from multi-county park status – are as follows:

• Tier I: $1,500.00 per year, per job.

• Tier II: $2,750.00 per year, per job.

• Tier III: $20,250.00 per year, per job.

• Tier IV: $25,000.00 per year, per job.

The amount of available JTCs for qualifying jobs created in lower-income Tier III and Tier IV counties saw a dramatic increase over last year as a result of the passage of the “Panthers Bill” (H.B. 4243) earlier this year. The law increased JTCs for new, full-time jobs from $4,000 to $20,250 per job in Tier III counties and from $8,000 to $25,000 per job in Tier IV counties. For a taxpayer creating new jobs in a Tier III or Tier IV county in a tax year which begins on or after January 1, 2019, this updated new credit amount applies. On December 11, the South Carolina Department of Revenue issued Revenue Ruling No. RR 19-11, which provides additional clarification on the impact of the new JTC amounts for Tier III and Tier IV counties.

Notably, the following counties underwent a change in tier from 2019 to 2020:

• Laurens: Changed from Tier II to Tier III

• Edgefield: Changed from Tier III to Tier II

The updated tier rankings apply for new, full-time jobs created in tax years that begin in 2020, where the JTC was first earned on or after January 1, 2020. JTCs are claimed by filing South Carolina Form TC-4 with the company’s annual tax return.

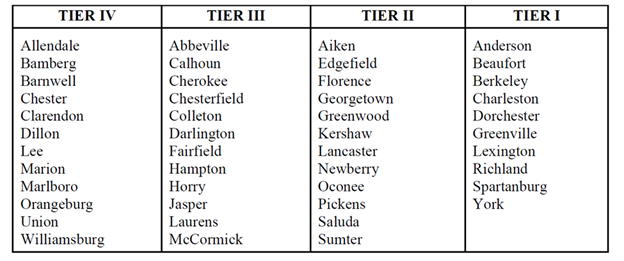

The complete list of county tier rankings is set forth below.

For additional detail, please see the South Carolina Department of Revenue’s SC Information Letter #19-29, which can be found here.

If you have questions about any of the information contained in this Client Alert, or you are contemplating new investment or job additions in South Carolina and would like to learn more about these and other valuable incentives that may be available, please contact a member of the Womble Bond Dickinson Economic Development Team.

Womble Bond Dickinson’s Economic Development Team helps clients explore opportunities for locating or expanding operations in the Southeast and Mid-Atlantic U.S. Our Economic Development Team combines a thorough working knowledge of economic development incentives; land use and siting procedures; and regulatory matters at the state, county and local levels, drawing on strong relationships built over many years with key governmental and civic leaders.