Womble Bond Dickinson 2022 Energy Transition Outlook Survey Report

Dec 07 2021

Click here to view this report as a PDF.

Transitioning the global economy out of its current reliance on fossil fuels involves a massive, complex and nuanced undertaking. Fossil fuels represent 80% of current global energy consumption, and the market for them exceeds $6 trillion per year. Even in 2021, the use of fossil fuels continues to expand faster than the rate at which renewable energy can be deployed.

The primary drivers of this energy transition are societal expectations and resolve, rather than technological innovation or changing demographics as has been the case with comparable market upheavals. But expectations and resolve are mercurial forces. In addition, no single technology or group of technologies has yet emerged to fill the gap that fossil fuels may eventually leave. The technological path that the industry will take remains uncertain.

In the face of these complexities and uncertainties, identifiable insights and perspectives can be gleaned from across the energy industry. To capture these insights and perspectives, the global energy team at Womble Bond Dickinson (WBD) has surveyed a carefully selected group of 170 energy sector decision-makers, including C-suite executives, investors and in-house legal counsel. These leaders represent a broad spectrum of energy sub-sectors including oil and gas, power and renewables, and mining and minerals. They have a unique vantage point concerning the transition and a need to understand what it means for their businesses.

The data gathered in this effort paint a fascinating snapshot of where the transition stands today:

This survey’s findings paint a picture of what has always been a dynamic industry now beset by overwhelming and, in many ways, existential challenges. It is our hope that the conclusions herein shed light on the fluctuations, sentiments and opinions of those who manage and invest in these complex technologies and organizations. One thing is certain: the global demand for energy will inevitably increase with an expectation that the world’s population will grow by as much as 2 billion between now and 2050. With fossil fuels alone it would be challenging to meet this need. Add in the requirements for renewable energy, and the journey to achieving net zero will require an unprecedented amount of creativity, flexibility, and concerted determination for years to come.

In the charts and analysis, responses to some questions do not add up to 100% due to rounding, and some exceed 100% because respondents were invited to select more than one answer. Responses from “executives” comprise those with C-suite titles, business or operations managers, and in-house legal roles. For the full survey methodology, click here.

Jeffrey Whittle

Co-Head, Energy and Natural Resources Sector

Head, Energy IP Subsector

Houston Office Managing Partner

[email protected]

Lisa Rushton

Co-Head, Energy and Natural Resources Sector

Head, Renewable Energy Subsector

[email protected]

Belton Zeigler

Co-Head, Energy and Natural Resources Sector

Head, Utilities Subsector

[email protected]

Seventy-seven percent of industry executives reported that they were already focusing on or considering carbon-neutrality measures. “Carbon-neutrality initiatives go well beyond simple energy efficiency bottom-line concerns and reflect a larger shift driven by societal expectations, changing investment approaches and, of course, grass roots activism,” said WBD partner and Energy and Natural Resources (ENR) sector co-lead Jeff Whittle. Whittle is the managing partner of WBD’s Houston office with a patent and technology practice that focuses on energy. “The industry is clearly looking long-term and sees its future as having a very different shape from what it is today,” Whittle said.

Notably, the focus is broader than just carbon neutrality. There is equal embrace (79%) of pollution-neutrality throughout the industry.

The embrace of climate goals by industry leaders is matched by their reported levels of preparation to meet them. More than two-thirds of executives (73%) and investors (70%) say that their companies or those in which they invest are either very prepared or moderately prepared to achieve more than a 50% reduction in carbon emissions by 2030. The data show even stronger values related to reduction of methane emissions by 2030 (executives 77%; investors 71%).

“Five years ago, it would have been difficult to believe that three-quarters of energy executives would feel this well prepared for carbon and methane reductions – and that investors would feel the same way about their portfolio companies,” Whittle said.

“Five years ago, it would have been difficult to believe that three-quarters of energy executives would feel this well prepared for carbon and methane reductions – and that investors would feel the same way about their portfolio companies.”

Confidence in financial ability to sustain this transition underpins this open perspective. Only 30% of respondents in C-suite or business or operations managers roles list capital and investment as a major challenge. A similarly small percentage (37%) see federal incentives and tax breaks as potential stumbling blocks. Less than half of industry executives (43%) see the implications of stranded assets as a major concern.

“The C-suite clearly believes it has the financial resources to replace current revenue with new investments and markets,” said WBD partner and Energy and Natural Resources sector co-lead Belton Zeigler. “From a financial perspective, the industry sees more opportunity than threat. This is good news. It takes a major source of resistance to the transition and potential source of failure in executing it off the table.”

“From a financial perspective, the industry sees more opportunity than threat. This is good news. It takes a major source of resistance to the transition and potential source of failure in executing it off the table.”

Still, respondents identified several areas in which government regulations, tax incentives, and public-private partnerships could make a difference. For example, a significant majority of those surveyed who are active in renewables agree that there should be a federally mandated program to certify green gas, as opposed to a patchwork of local and state rules. “This is a prime example of how the federal government has a real role to play in improving the business climate for renewables,” Zeigler said. “When you’re a business, the last thing you want to be doing is having to check and comply with multiple state regulatory constructs impacting your markets.”

Consistent with their generally “can do” perspective, respondents in C-suite or business or operations managers roles consistently recognize the complexities related to regulations (48%) and understand new technologies (41%) . These are just the sorts of challenges that sophisticated and well-led companies can manage.

But respondents did not gravitate toward one overwhelming issue as the dominant challenge. Rather, most answer choices resonated with large numbers of respondents, indicating a multifaceted range of problems. All answer options, including intellectual property challenges, inadequate federal support and tax incentives, and availability of capital, were chosen by at least 30% of respondents, indicating a broader spectrum of issues.

“The industry’s current openness to the transition may be due in part to the fact that the technological and market path forward is still open, and winners and losers have not been identified,” said WBD partner and Energy and Natural Resources sector co-lead Lisa Ruston. “Even players that are entrenched in current markets and technologies have the opportunity to pivot and capture value going forward.”

“Even players that are entrenched in current markets and technologies have the opportunity to pivot and capture value going forward.”

Across the board, energy industry investors and lawyers see the transition as posing greater challenges than do industry executives. Compared to their counterparts on the front lines of the transition, investors are more concerned about stranded assets (67% vs. 43%), the availability of federal incentives (49% vs. 37%), the challenges posed by intellectual property (47% vs. 34%) and the complexity of the required infrastructure (56% vs. 48%).

The industry’s in-house lawyers generally fall in the middle. They are more apt to see major challenges than their non-lawyer colleagues (issue spotting is their job, after all) but are less concerned than investors. Not surprisingly, those in legal roles are more worried that their executive colleagues about areas that fall under the law department’s purview – like regulations and intellectual property challenges. And a majority of attorneys see the unforeseen challenges and implications brought about by technological evolution as a major hurdle (56%). Lawyers, after all, are not engineers.

“This is reassuring,” Ruston said. “The executives who are closest to the challenges are more confident about their ability to overcome them. If the opposite were true, it would be troubling.”

Respondents’ bullish outlook on the transition is also shown in their embrace of the Biden Administration’s more aggressive climate policies. The survey found that both executives (70%) and investors (78%) see that the administration’s policies as having a positive impact on their businesses.

“The fact that the new administration is prioritizing these efforts is seen as a welcome change in contrast to the hesitancy of the previous administration to embrace climate initiatives,” said Rushton, who, in addition to serving as Energy and Natural Resources sector co-lead, is a Raleigh-based partner in WBD’s Environmental practice. “Many in the industry likely see the potential for big returns, whether they’re utility companies already betting on solar and wind or upstream players who see potential in hydrogen and other longer-term plays.”

Despite a comfort with the administration’s plans, one-third (32%) of respondents believe that the Biden Administration will meet its goal of decarbonizing the power sector by 2035. Half (49%) believe it is unlikely or very unlikely.

Respondents who were bearish about Biden’s goals saw the principal barriers as cost (31%) and speed of the transition (25%). Industry resistance was ranked in the single digits (4%) as an obstacle, again confirming that industry is prepared to embrace the change.

You indicated that you do not think it is likely that the US will reach President Biden's target of decarbonizing the power sector by 2035. Which answer choice best describes why you feel this way?

| Cost-prohibitive nature of compliance | 31% |

| Transition is too fast for existing players | 25% |

| Lack of follow through on compliance | 19% |

| Insufficient or misappropriated government support | 13% |

| Industry resistance | 4% |

| Other (politics, infrastructure issues, length of regulatory process) | 8% |

“The magnitude and complexity of the projects required to make this shift is daunting,” said Zeigler, who has worked on a range of multi-year energy projects. “Power plants and major transmission lines take years to permit, site, engineer, procure, and construct. And that is with mature and well-understood technologies. In the world of major utility projects, there is not a lot of margin in the 14-year timeframe ending in 2035 for projects of the required magnitude.”

Industry leaders showed widespread receptivity to public-private partnerships, particularly around technologies that require very substantial infrastructure investment or R&D component such as wind turbines (68%), electric vehicle charging (66%), battery development (66%), blue hydrogen (59%), and carbon capture and storage (59%). Small nuclear (35%), and transmission upgrades (45%) scored low.

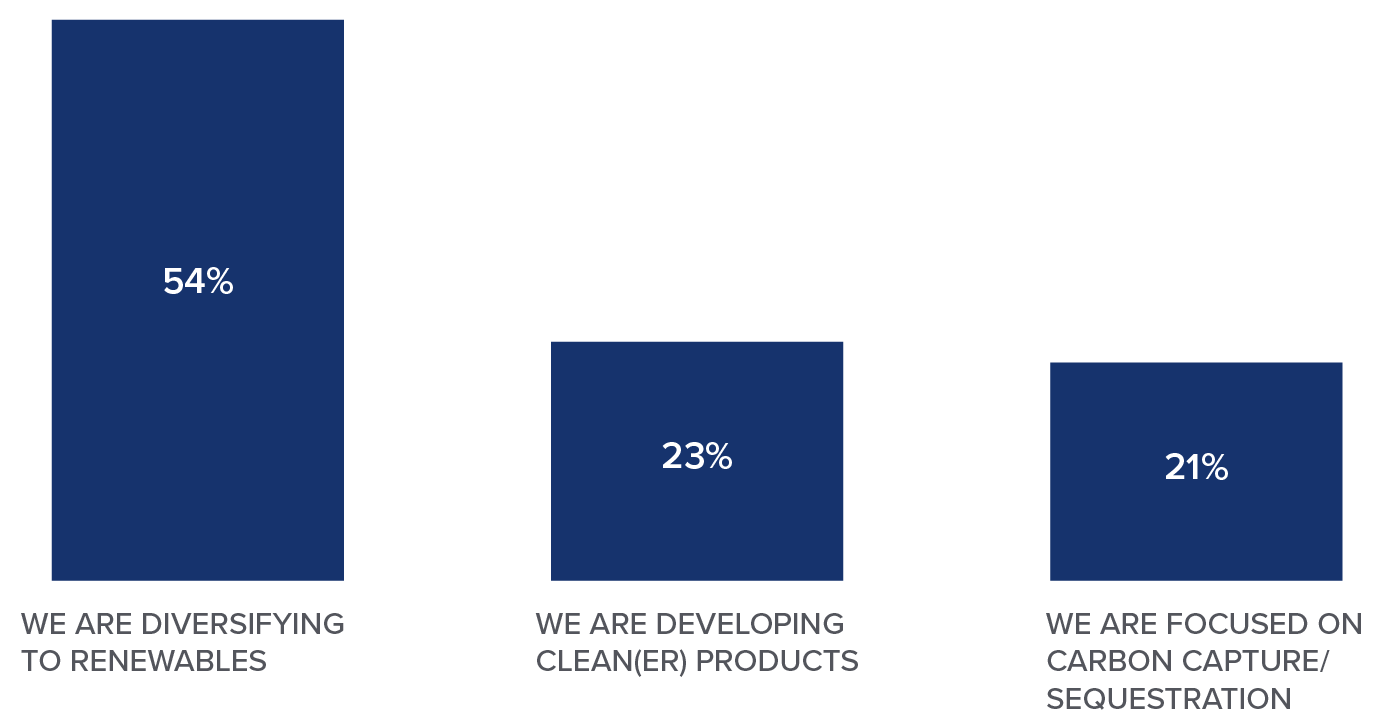

Industry leaders who report that their firms are well-prepared or moderately prepared to reduce greenhouse gas emissions plan to do so by diversifying into renewables (54%) and developing cleaner products (23%). At this stage of the process, they are relying most heavily on internal R&D (76%), third-party guidance and consulting (58%), and new internal support and hiring (47%). Diversification through M&A scored at the lower end of the scale (14%). This suggests that the industry does not believe that winning technologies or market offerings are there to be acquired or are available at reasonable cost vs. risk today.

Which of the following best define(s) how you expect to reduce GHG?

This chart reflects responses from executives who indicated being prepared at some level to meet a commitment to a reduction of more than 50% in methane and CO2 emissions by 2030.

“All these data points are consistent with an industry at the leading edge of evolving technology and markets,” Whittle said. “The winning technologies and market offerings are still emerging and must be developed with internal or contracted expertise. They are not yet available on the IP or M&A market. The M&A market needs to mature.”

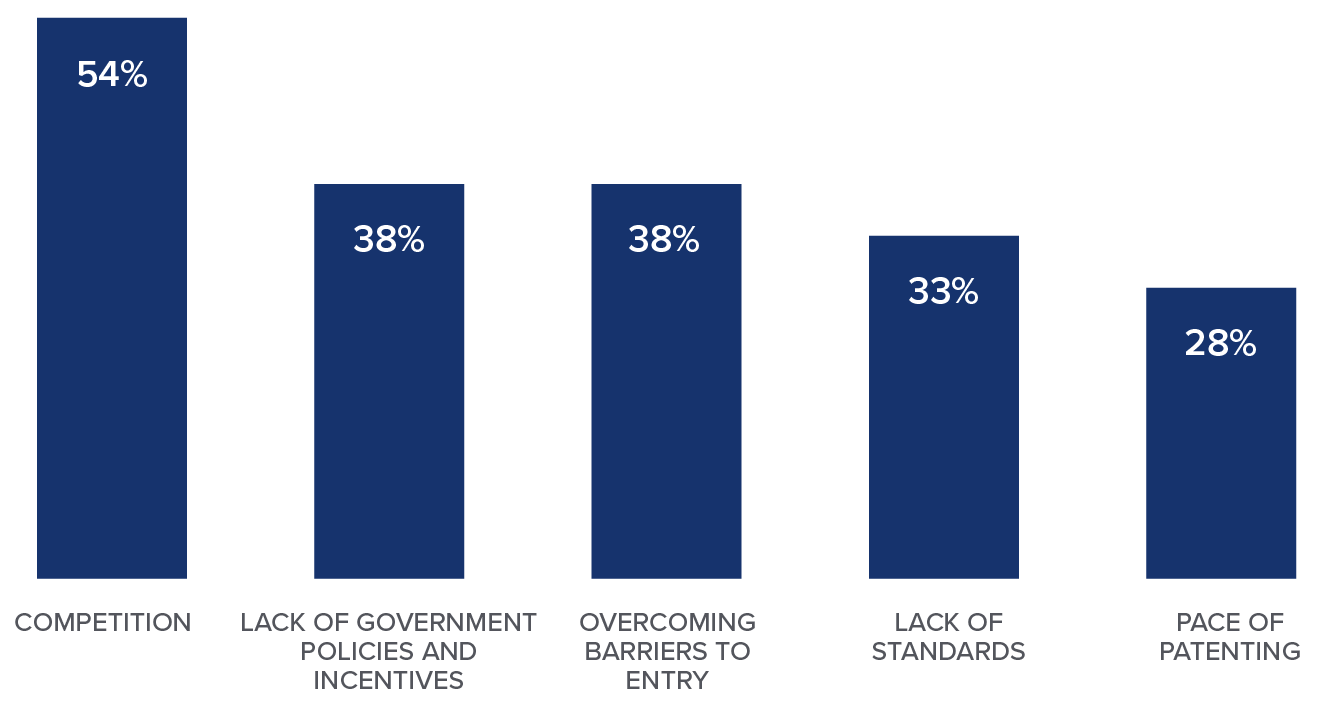

Consistent with the evolving nature of technology, nearly two-thirds of executives (66%) see IP considerations as a significant challenge to renewable energy development. Industry leaders identified competitive risk (54%) as a primary concern. “With the technology still in flux, there is a real fear out there of being locked out of new markets by being late with IP,” Whittle said. “The race to be sure firms carve out their own path to profitably in this transition to cleaner energy is shown by the recent increase of patent filings in this sector, even as they remain below the levels of 10 years ago. This will accelerate. Competition to innovate is fierce.”

“The race to be sure firms carve out their own path to profitably in this transition to cleaner energy is shown by the recent increase of patent filings in this sector, even as they remain below the levels of 10 years ago. This will accelerate. Competition to innovate is fierce.”

Which of the following present IP challenges to renewable energy development? (Please select all that apply)

This chart reflects responses from executives who identified that IP considerations play a “very significant” or “somewhat significant” challenge.

Not surprisingly, at least 35% of respondents are actively operating, investing in, or researching established renewable technologies including solar, geothermal, hydro and wind. Taking into account the number of respondents who are contemplating taking action next year, the total reaches at least 60% of respondents who are involved in these renewable energy resources, except for hydro, which fell just short at 58%.

“The data identify no clear areas of early concentration in newer technologies,” Zeigler said. “The industry appears to be hedging its bets across many fronts. At the same time, it is surprising to see the amount of activity in hydrogen – which is relatively new to the party – and geothermal, which has been something of sleeper to date.”

Looking further afield, the spread between technologies becomes wider. The most appealing growth opportunities in the eyes of executives seem to be battery storage (69%), hydrogen (67%), energy efficiency (58%), and electrification (56%).

Battery Storage. Batteries are a requirement for the transmission and transportation of renewably sourced energy. “The output of solar and wind resources varies with atmospheric conditions, not real-time customer needs,” Zeigler said. “To get the maximum value from these resources, they need to be paired with batteries that can feed stored energy back to the grid when needed.

Hydrogen. To meet climate goals, the electric industry must replace natural gas as a primary fuel to meet load growth while retiring coal-fired and nuclear power plants. Today, the industry depends heavily on natural gas for new generation. Hydrogen, and increasingly its analog ammonia, are emerging as the principal green fuels that could replace natural gas. The UK is experimenting with hydrogen for residential and commercial space heating and cooking. Hydrogen clearly checks multiple boxes as far as industry executives are concerned, and its 67% score as a R&D investment opportunity reflects that fact.

Biomass. The popularity of biofuel and biomass makes sense, especially for refiners. “Many of them are moving in that direction as a result of pressure from investors and executives who view the transition from diesel to biofuel as low-hanging fruit,” Whittle said.

Solar PV, Onshore Wind, Geothermal, and Transmission. The industry appears to see solar PV (26%) and onshore wind (11%) as somewhat saturated markets. Geothermal (17%) and hydro (15%) are site-limited resources, which may explain their low scores. Transmission and interstate pipeline construction is a highly regulated and specialized business principally concentrated in the hands of large utilities and interstate pipeline entities. Further, recent high-profile delays and failures of major projects show the risks that even the most seasoned developers face. Transmission’s low score of (16%) is consistent with those facts.

Offshore Wind. It’s notable that offshore wind, which is a new but burgeoning resource in the US, scored so low (17%). The size and lack of US experience curve in offshore wind may be the cause. “Europe is 20 years ahead in this sector and a relatively small group of European companies, in partnership with US utilities and oil majors, are leading the charge here,” said Zeigler, who is a board member of the industry’s leading trade association, the Business Network for Offshore Wind. “It may be that the small number of entities with the capital and expertise to tackle these projects explains this low number. The score is certainly not indicative of the scope of current activity and investment.”

Nuclear. Given the spectacular failure of recent new nuclear projects and the attendant regulatory complexities, the energy industry will need evidence that nuclear is a viable investment option going forward. “Some believe that nuclear must happen for the nation to reach its climate goals, but we clearly are not there yet,” Zeigler said. Well-financed, high-profile projects show a determination to demonstrate that nuclear can be done safely and cost effectively with smaller units. But today, the industry remains unconvinced.

The technological path for producing and delivering hydrogen at reasonable cost and without carbon emissions is unclear, as is the path for converting existing pipeline and storage infrastructure from natural gas and LNG to hydrogen. So, it is not surprising that industry executives most often identified hydrogen (38%) as the technology for which R&D is most important, with biofuels/biomass (29%) and geothermal (27%) as the only other fuels receiving more than 25%.

The survey drills down on the key challenges to hydrogen as seen by investors and executives active in or considering operations/investment in hydrogen. Executives most often listed technology issues regarding supply and storage (57%), absence of infrastructure (54%), and public safety concerns as principal challenges. But they were less concerned about the complexity of distribution (41%) indicating that the existing natural gas and LNG infrastructure provides a technological basis for hydrogen distribution. Few executives listed cost curve uncertainty as an issue (21%) indicating confidence that the cost of hydrogen can be brought down to a point where it becomes an economically practical fuel source.

Investors see markedly more challenges for hydrogen than executives. Seventy-four percent of investors believe hydrogen distribution is too complex, yet fewer than half (41%) of the executives surveyed feel that way. Similarly, the percentage of investors who worry about cost curve uncertainty (56%) is more than double the percentage among executives (21%). This is a stark contrast to the opinions of managements outlined above.

Why the disparity? It may be that investors’ lack of enthusiasm for this emerging technology is due at least in part to the dearth of pure play companies (of size) and/or investment mechanisms exclusively focused on the resource. Companies actively pursuing hydrogen development are often oil majors or other diversified companies. Solar and onshore wind, on the other hand, are replete with pure play investments and tightly focused funds.

Seventy-four percent of investors believe hydrogen distribution is too complex, yet fewer than half (41%) of the executives surveyed feel that way. Similarly, the percentage of investors who worry about cost curve uncertainty (56%) is more than double the percentage among executives (21%).

Investors and energy executives are, however, very much aligned on the value of green hydrogen – or hydrogen generated purely from renewable resources, such as electrolysis of water. About half of those who reported hydrogen as a current area of activity see blue hydrogen as a bridge to green. Blue, by contrast, is generated from natural gas. The carbon dioxide byproduct is then captured and stored.

Nearly 30% of each group says green hydrogen is “worth the wait.” This conviction is further reinforced by the fact that the current cost of green hydrogen is at least twice that of blue, suggesting a belief that this gap can be narrowed over time.

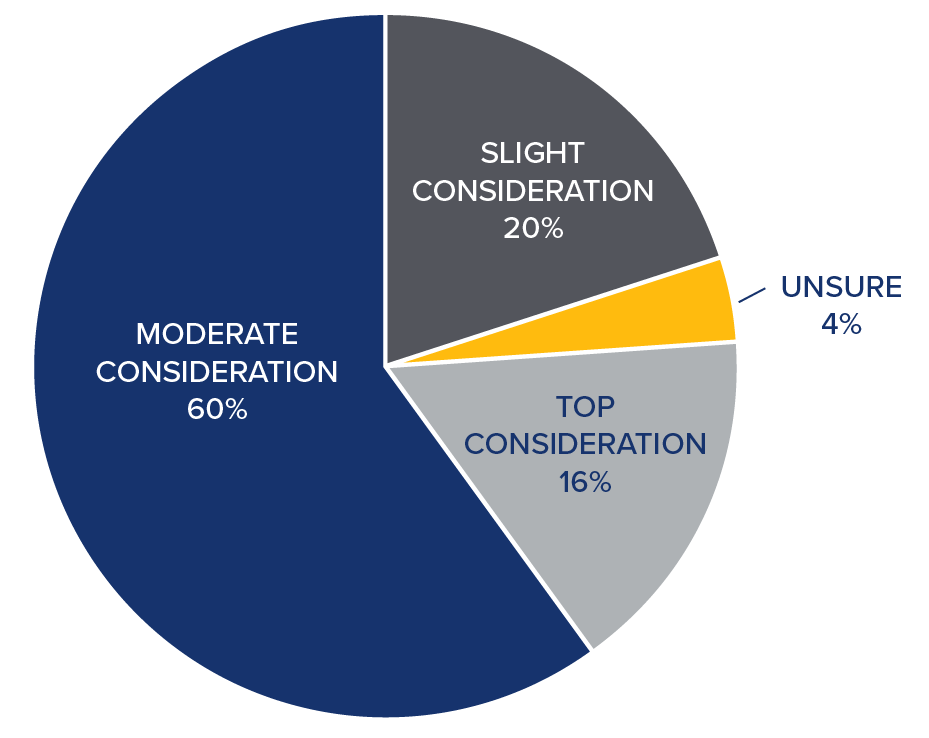

The institution of environmental, social and governance (ESG) values and metrics represents a true revolution not only in how corporations are managed, measured, and operated, but also in the focus of many companies’ underlying goals and mission statements. The reasons for this are multifold and not unique to any particular sector. Investors are increasingly tracking corporate performance based on an ESG matrix. ESG policies are influencing talent wars. Customers are making buying decisions predicated on their suppliers’ ESG policies. Moreover, boards are beginning to tie executive compensation to the successful implementation of ESG policies and practices.

It also can’t be overlooked that there has been a noticeable move on the part of financial institutions and investors when it comes to their evaluation of investments. This highlights a distinct shift from what was once almost a pure assessment of a rate of return on investment to a landscape where more than 76% of investors today place at least a moderate emphasis on ESG issues when making investment decisions.

More than 76% of investors today place at least a moderate emphasis on ESG issues when making investment decisions.

The reality is that we have been moving toward a more holistic approach of managing companies for years. Recent events related to climate change, social unrest, and COVID-19 have pushed ESG concepts to the forefront for investors, customers, employees, and most corporate stakeholder. As Rushton noted in a recent article, ESG: How it Applies to the Oil & Gas Industry and Why It Matters, “a lack of ESG strategy will ultimately affect a company’s access to public, and increasingly private, capital.” Regardless of the drivers, it cannot be denied that ESG has played, and will continue play, a material role in accelerating the world’s transition to green(er) energy.

To what extent does your firm prioritize ESG policies in evaluating investment opportunities within the energy sector?

This chart reflects responses from investors.

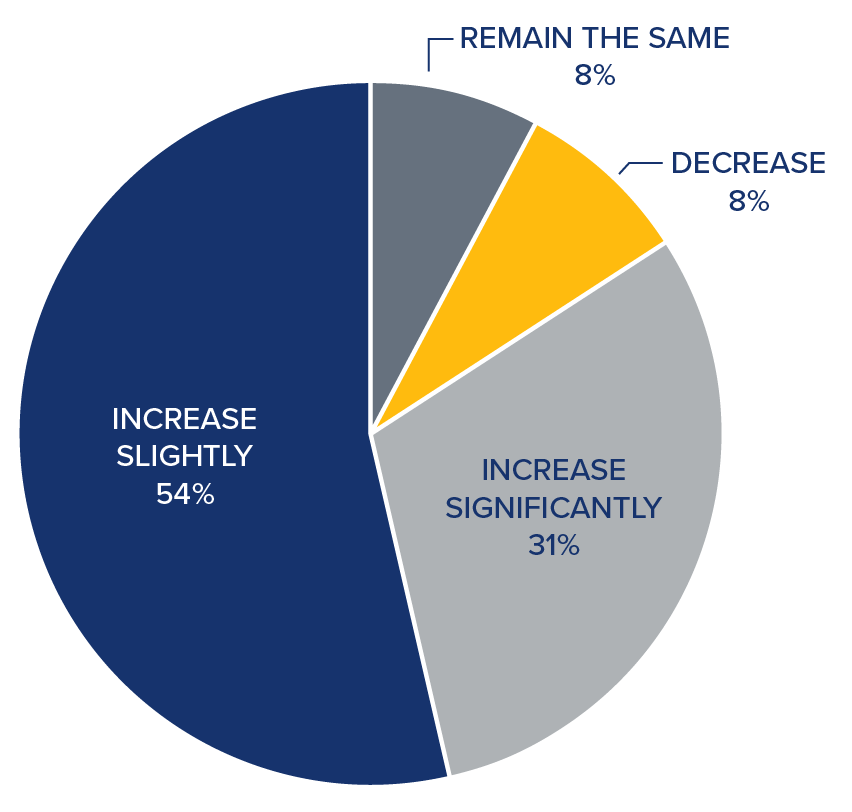

What is your perspective when it comes to the focus on ESG in investing over the next two years? Please complete this sentence: I think the focus on ESG in investing will __________over the next two years.

This chart reflects responses from investors.

Despite tailwinds from investor, board, employee, and customer interest in ESG, there exists a level of uncertainty as to how companies should approach ESG policies and programs. For this very reason – despite what appears to be a “ESG imperative” – many companies have a range of trepidations with regard to embracing fully the ESG movement, including lack of standards and expense. Interestingly, data exist to show that ESG can improve costs, particularly for those in the energy sector.

But many companies are plowing ahead, even though they have questions that typically revolve around how to set targets, who is setting applicable standards, and concerns over public commitments that may be hard to meet.

The green transition has begun in a powerful way, driven by social expectations and regulatory pressures. Both energy executives and investors alike see the tide changing and are making concerted efforts to hasten the process. As the graphical data presented in this report indicate, the direction and speed of this change is already notable. Still, the path remains long, and it will clearly take considerable time to accomplish the transition to green energy.

In September 2021, 170 decision-makers in the energy industry completed an online survey to gauge the industry’s readiness and outlook on the transition to clean energy and related topics. Respondents included C-suite executives (32%), business or operations managers (7%), and in-house legal counsel (29%) – a group we combined and called “energy executives” throughout this report – as well as investors (29%).

In addition to the range of professionals surveyed, there was a mix of energy industry sub-sectors, including power and renewables, oil and gas, utilities, mining and minerals, and pipelines/transportation. Over half of the surveyed companies (55%) employed more than 5,000 people, and 84% of the organizations had corporate headquarters in the US.

Respondents reported their organization’s estimated 2020 revenue with 32% of the sample reporting $10 to $500 million, 33% reporting $501 million to $5 billion, 22% reporting $5.1 billion to $10 billion, and 12% electing not to disclose.

Womble Bond Dickinson’s Energy and Natural Resources Sector is a multi-disciplinary group of more than 55 attorneys skilled in counseling companies and investors as they navigate the challenges and complexities of the energy transition. Our team provides practical and innovative solutions to support clients in their quest to achieve sustainable growth, strong returns on technology investments, and ESG-focused success at this time of unprecedented industry transformation.

Our work covers the broad spectrum of energy subsectors including the upstream, midstream, and downstream segments of oil and gas, power and renewables, all types of electricity generation, and commodities and trading. Our global practice addresses the full range of clients’ transactional, intellectual property, regulatory, and litigation needs.

Womble Bond Dickinson’s diverse client base includes integrated energy entities and established industry players, as well as those entrepreneurs and early-stage companies who are at the forefront of change as they innovate, monetize, and commercialize the technologies of our green(er) energy future.