Tariffs and Other Regulatory Charges on Imported Goods

Mar 14 2025

This is the first installment in a series of pieces in which members of the Womble Bond Dickinson Global Trade Advisors (GTA) team will review a number of current issues in international trade regulation. The authors will discuss strategies for companies to stay aware of change in this dynamic area of law and achieve their business goals, while avoiding regulatory noncompliance costs.

In this first piece, we will review the regulatory landscape of, and recent practice regarding, tariffs and other regulatorily mandated charges on imported goods including, in particular, antidumping duties (ADD) and countervailing duties (CVD).

Changes to U.S. tariff rates have been highlighted in the news lately as the Trump administration seeks to use increased tariffs to achieve a variety of stated aims. The Womble international trade team recently published a piece reviewing recent tariff rate change announcements and implementation. It is clear that we are in a time of dramatic change to U.S. tariff law and policy.

Tariffs, of course, are taxes charged on imported goods at the point of entry into a customs territory. Since the establishment of the General Agreement on Tariffs and Trade (GATT) in 1947, the U.S. and other member states have typically complied with the provisions of GATT Article II, which obligate all member states to publish and bind themselves to a tariff schedule. This schedule lists the tariff rates to be applied to all goods imported into the country, using an item classification system called the Harmonized Tariff Schedule (HTS). Countries periodically negotiate with each other on tariff rates and apply the nondiscrimination provisions elsewhere found in the GATT (and since 1995 enforced through the World Trade Organization (WTO)), in order to lower tariffs generally.

This system has overall been quite effective in lowering tariffs around the world. For example, in 1947, the average U.S. applied tariff rate was around 30%. Today it is around 2.3%. This doesn’t include the various free trade agreements to which the U.S is a member, which frequently allow goods to be imported into the U.S. tariff-free. In fact, roughly 70% of imports enter the U.S. tariff-free.

In U.S. domestic law, Congress has essentially statutorily delegated the setting of tariff rates to the President. Various executive branch agencies play a role in exercising these powers, including the Office of the United States Trade Representative (USTR), the Department of Commerce (DOC), the Department of the Treasury (TREAS), and Customs and Border Protection (CBP). In a number of statutes, Congress has granted the President extraordinary powers to set tariffs in response to dynamic changes in international affairs. These include particularly:

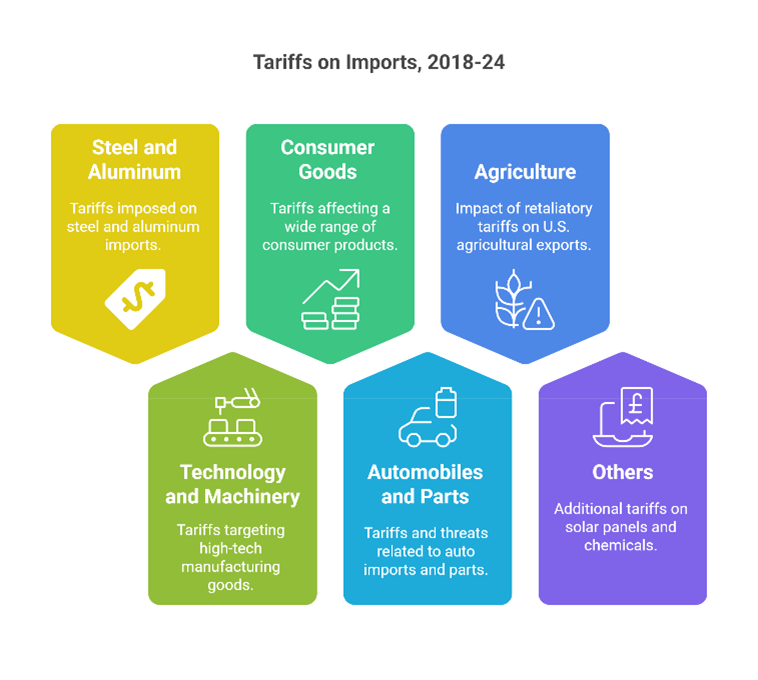

U.S. tariff practice has changed considerably since 2017 and become much more dynamic than in previous decades. Shortly after coming into office in 2017, President Trump ordered an unfair trade investigation into China’s technology transfer and intellectual property laws. These investigations culminated in the imposition of increased tariffs on $370 billion of imports from China – roughly 73% of all U.S. imports from China – of from 10% to 25%.

Similarly, the Trump administration in 2017 also began an investigation on the national security implications of the importation of steel and aluminum products. This investigation led to increased U.S. tariffs on imports of steel and aluminum products by 10%-25%. While some adjustments to these targeted tariff increases were made during the years of the Biden administration, such as reinstating certain product exclusions to alleviate specific industry concerns, the essential structure and substance of these tariff increases has remained in effect to the present.

Since his return to office in January 2025, President Trump has announced or proposed a number of new targeted tariff increases, though so far the application of many of these tariffs has been deferred. The key stated objectives of these additional tariffs are to protect domestic industry, reduce dependance on China, counter unfair trade practices, enhance national security, and to establish strategic leverage for negotiations.

Tariffs are typically paid by an importing company at the time of customs clearance. This company may or may not be closely associated with other companies in the supply, manufacturing, and retail chain. This creates complex interactions between and among companies in the supply chain and can result in the cost of the tariff being passed on among companies, possibly affecting the price of the goods at point of sale to consumers.

At present, U.S. trade regulations include, unless specifically waived, a de minimis rule which allows imported goods delivered in the U.S. with a value less than $800 to enter the country tariff free. This has allowed direct shipment of packages by some foreign exporters to U.S. consumers duty free. Goods that enter under the de minimis rule are generally not subject to Section 301 or Section 232 tariffs.

Another source of regulatorily mandated charges on imports of goods, so-called trade remedies, comes from regulations concerning dumping and subsidies, which are typically classed as unfair trade practices. The U.S. government regulates these unfair trade practices through a complex system of investigations and determinations through an interagency process, that can result in the imposition of ADD or CVD on imports, which apply in addition to any tariffs that may be due.

The primary statutory authority for AD and CVD measures is the Tariff Act of 1930, as amended by subsequent legislation, and as implemented through regulations issued by the DOC, the U.S. International Trade Commission (USITC), and the CBP. The process leading to the imposition of ADD or CVD begins with petitions filed with the DOC and ITC by U.S. industries or, in some cases, self-initiated by DOC. The post-petition process is different in the ADD and CVD contexts, but both follow a similar parallel process through which both the DOC and ITC complete different parts of the investigation. The DOC ultimately determines whether dumping or unfair subsidies exist and calculates the economic impact of those actions. The USITC determines whether U.S. domestic industry has suffered a material injury stemming from this unfair trade practice. Then the DOC determines whether AD or CVD should be ordered to be applied to the subject imports in order to counteract this injury and calculates the amount of the duties. CBP then enforces and collects the duties as ordered by the DOC. DOC then conducts regular reviews of the AD/CVD orders.

In recent years there has been increased activity in both petitions and investigations into dumping and subsidies. ADD/CVD orders have varied by country and by commodity. Recent subjects of investigations include:

Metals (Steel and Aluminum): Metals are the single largest category under AD/CVD protection. The majority of all current AD/CVD orders are on iron and steel imports. As of 2017, for example, 40% of all U.S. AD/CVD orders in place were on steel products. This trend has continued – by 2024, there were over 300 active orders on steel and steel-related products alone. The steel industry has benefited from these measures through reduced import competition; the American Iron and Steel Institute noted the prevalence of unfairly traded steel imports and stressed the importance of vigorous enforcement of AD/CVD laws for the sector. Aluminum products have also been targeted (e.g. aluminum extrusions, sheet, foil from China and other countries). After duties on aluminum foil from China were imposed, U.S. producers saw tangible relief: Chinese aluminum foil imports dropped by 64% and domestic investment in foil production increased by $169 million within a year. This suggests AD/CVD actions in metals achieved their intended effect of curbing unfair imports and bolstering U.S. industry.

Further, the DOC in particular has expanded its authority to apply its Particular Market Situations (PMS) doctrine, which allows it to adjust cost calculations when foreign market distortions are present. It has also increased its scrutiny of state-owned enterprises (SOEs) and indirect subsidies, particularly in non-market economies (NMEs) like China.

ADD and CVD are increasingly being used as part of the U.S. government’s focus on addressing what it considers to be unfair trade practices by other countries, which harm U.S. industries.

Common Commodities Subject to ADD and CVD Duties:

The past few years have seen a marked increase in the imposition of tariffs, ADD/CVD, and other regulatorily mandated charges on imported goods. For importers and companies all along the supply, manufacturing, and retail chain, these import charges are important to understand and monitor.

The most important step businesses can take is to practice informed Compliance. They can do this by staying current on changes to tariff rates and ADD/CVD duties which apply to goods in their supply chain. Companies should identify in detail the actors, both upstream and downstream, in their supply chain, and the goods that may be impacted by changes in tariffs and impositions of ADD/CVD. Maintaining this awareness of changes and supply chain dynamics can help in potentially identifying alternative suppliers of goods and other supply chain services.

Companies can also be active in making sure that HTS classifications, and values of imports are being calculated/assigned correctly, as these assessments can significantly affect duties imposed. They can investigate the possibility of use of free-trade zones, or bonded warehouses to minimize or postpone duty payments. And they can make sure they have a good working relationship and good communications with brokers and forwarders.

Partnering with industry experts and regulatory specialists can help with all of these tasks.

WBD GTAs assist companies in the establishment and maintenance of individualized internal compliance programs. We focus on advising companies on regulatory compliance strategies that help them monitor and adapt to regulatory requirements in this dynamic area of law, at a price point far below normal big law firm billing rates. Clients of WBD’s Global Trade Advisors can also, however, count on the full service backing of the firm’s International Trade and National Security team of attorneys if needed.

Importers must ensure compliance with antidumping (AD) and countervailing duties (CVD) to avoid penalties and shipment delays. Key compliance steps include:

Proactive compliance reduces risk, prevents delays, and ensures smooth trade operations under U.S. AD/CVD laws.