SBA’s Economic Injury Disaster Loan Program

Mar 18 2020

On March 6, 2020, the U.S. Small Business Administration (the “SBA”) announced it is expanding its “Economic Injury Disaster Loan Program” to include small businesses and non-profits impacted by coronavirus (COVID-19). This program provides targeted, low-interest loans of up to $2 million to qualifying small businesses (see below for qualification details) and non-profits in designated states and territories that have been severely impacted by COVID-19. This announcement was part of the Coronavirus Preparedness and Response Supplemental Appropriations Act signed by President Trump on March 6.

In order for qualifying businesses to access the loans, a state or territory’s governor must first request that certain counties within the state or territory have access to the Economic Injury Disaster Loans.

After the SBA approves the governor’s request, all businesses located within the applicable counties can apply for these loans (see below for details on the application process).

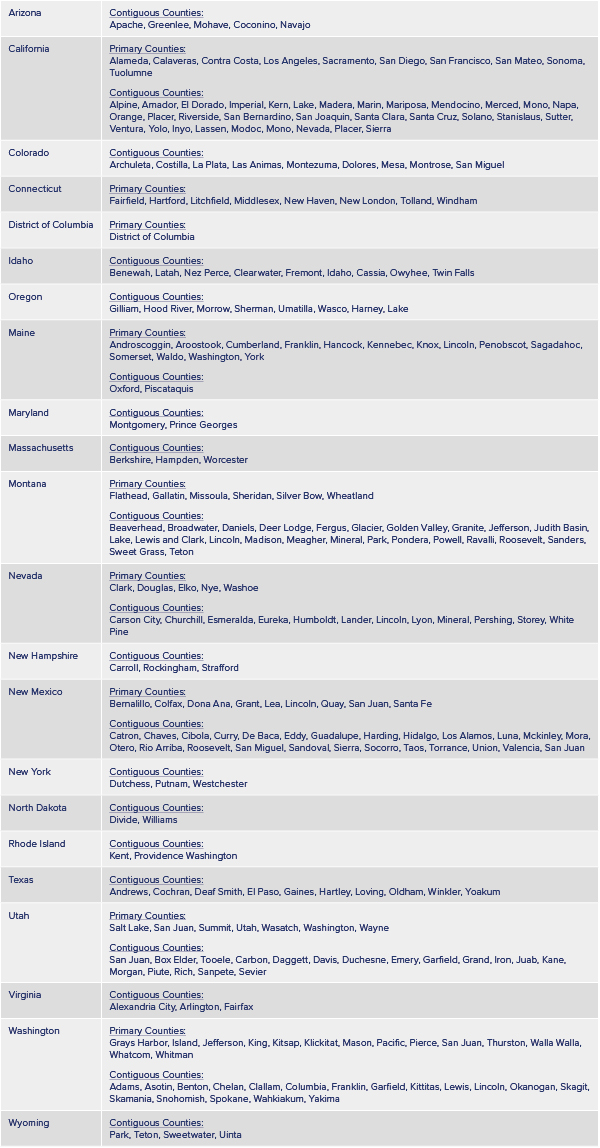

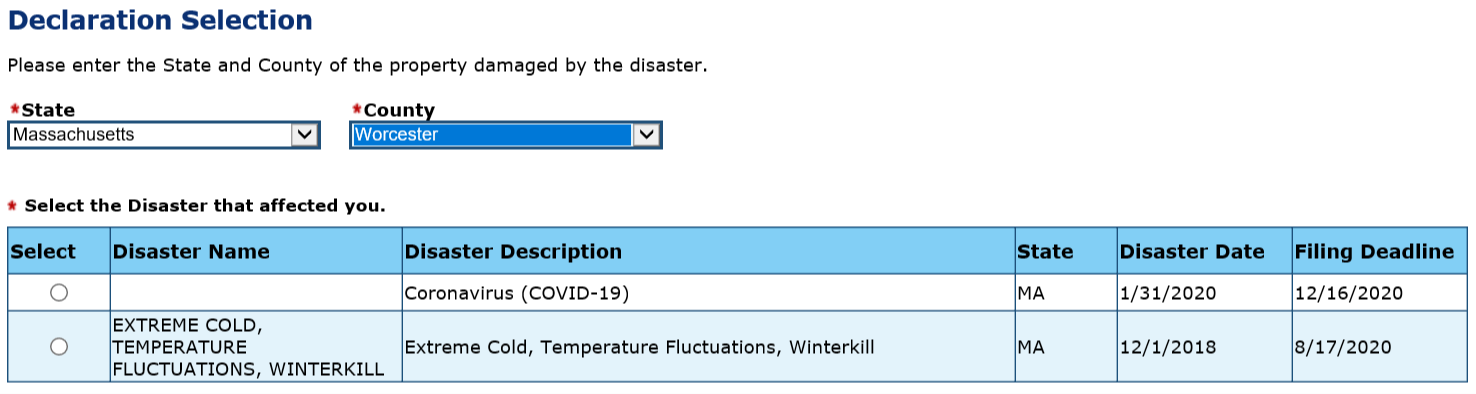

As of 2:00 PM on March 17, businesses located in the following counties may apply for these loans:

Click here to see the updated list (https://disasterloan.sba.gov/ela/Declarations).

Qualifying small businesses under the program are those which qualify as “small business concerns” under the Small Business Act (15 U.S.C. § 631, et seq.).

The definition of “small” varies by industry and is based on the business’ NAICS Code. However, you can determine if your business qualifies as “small” by using the SBA’s Size Standards Tool, or by referencing the SBA’s table of small business size standards.

Generally, the SBA calculates small business size based on the average annual receipts or the average number of employees. All calculations of annual receipts or number of employees must include those of certain affiliates. The definitions of “Affiliates,” “Annual Receipts,” and “Employee Calculation” can be found here.

In addition to the numerical standards, the business must:

The loans under the disaster program may be used to pay fixed debts, payroll, accounts payable, and other bills that cannot be paid because of the disaster’s impact. The interest rate is 3.75% for small business and 2.75% for non-profits. The maximum duration of these loans is 30 years, but each is determined on a case-by-case basis, based upon each borrower’s ability to repay.

Application Process

The following is a summary of the application process:

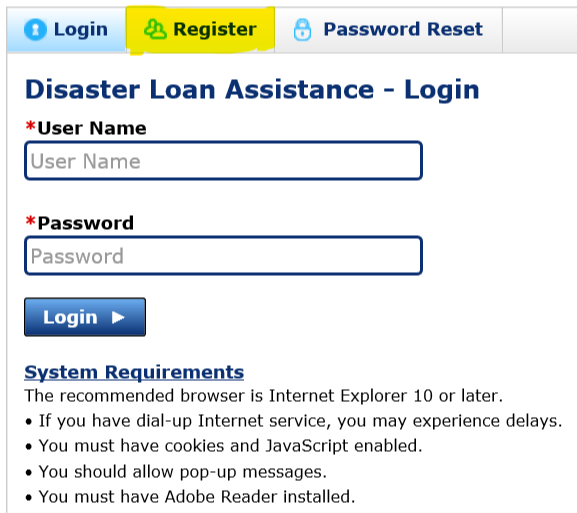

Prior to initiating your application, you must create an account. Please go to https://disasterloan.sba.gov/ela/ and click “Apply Online.” From there, choose “Register” and follow the prompts.

When registered, click “Apply Online” again. Then select “Businesses and Non-Profits.”

Choose the type of organization you applying on behalf of (e.g., corporation, limited liability company, etc.). Additionally, choose “Economic Injury (EIDL)” to apply for the Economic Injury Disaster Loan.

Next, assuming the county within your state has been designated as severely impacted by COVID-19, toggle through the menu options to select the appropriate designation location.

Follow the further prompts.

Please have the following information ready and available for the application itself:

Disaster Loan Application (SBA Form 5):

Complete SBA Form 413 (Personal Financial Statement) for each of the following with respect to the Applicant: (1) each proprietor; (2) general partner; (3) managing member of a limited liability company; (4) each owner of 20% or more of the equity of the Applicant (including the assets of the owner’s spouse and any minor children); and (5) any person providing a guaranty on the loan.

In addition, the form asks for the following information:

Complete SBA Form 2022 (Schedule of Liabilities):

Complete IRS Form 4506-T (Request for Transcript of Tax Return):

Federal Tax Return for Applicant Business:

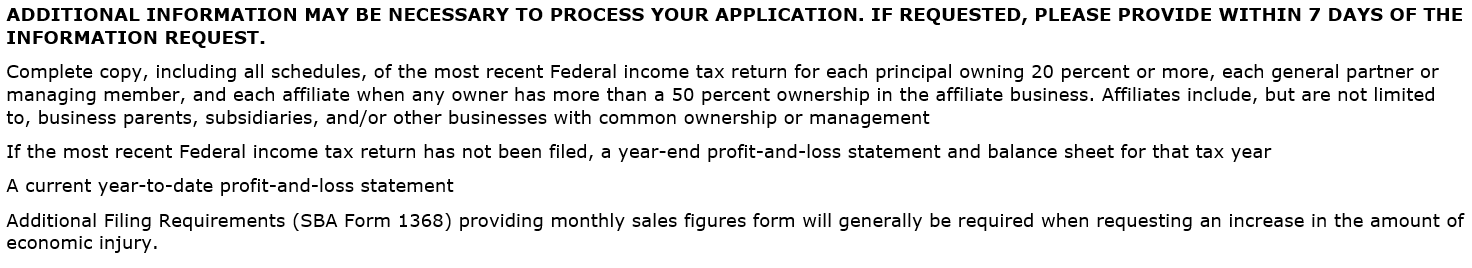

Finally, more information may be requested as the SBA processes the paperwork. See below screenshot.