This note combines several topics on which we’ve written: Bermuda (Feb 2017), offshore trust jurisdictions (May 2017), the Trump tax act and legislative updates (several).

First, Bermuda’s Economic Substance Amendment Act of 2019 became effective June 28, 2019. This legislation addresses definitions and concepts around “non-resident entities” for tax purposes. A nice summary by Appleby, our Lex Mundi affiliate, may be found here: https://www.applebyglobal.com/publications/latest-developments-in-bermudas-economic-substance-regime/

Second, on July 22, 2019, the Supreme Court of Bermuda determined that it has inherent jurisdiction for a “do-over”, by validating the 1999 appointment of a trustee (“1999 Trustee”) which had originally been invalidly appointed, was replaced by an invalidly appointed trust company from 2001-2015 , which was replaced again by the 1999 Trustee. The Supreme Court invoked policy reasons – the benefit in validating a trustee appointment over a trust with international trading operations – as part of its explanation. The court also acknowledged the difficult task of reconstructing and examining twenty years of decisions, not to mention the significant expense to the Trust. Pragmatism prevailed in C Trust [2019] SC (Bda) 44 Civ (22 July 2019).

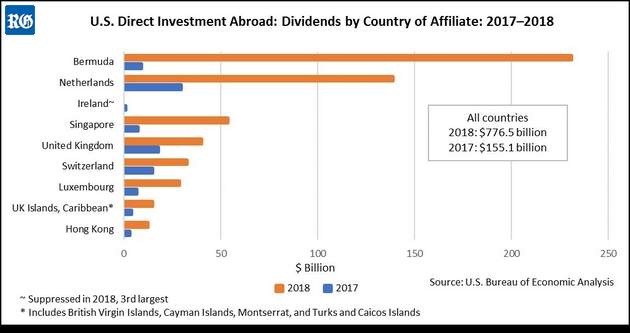

Next, while visiting, I noticed a brief article in the Royal Gazette that Bermuda is the largest source of repatriated profits to the US following the 2017 Tax Cuts and Jobs Act (“TCJA”).

On the larger issue, the TCJA has had a significant and positive economic effect. In 2018 and Q1 2019 approximately $876.8 billion have been repatriated. https://www.bloomberg.com/news/articles/2019-07-24/corporate-america-extracts-cash-from-bermuda-after-tax-change . In 2018, of the $776.5 billion that was repatriated, Bermuda alone represented $231 billion, or nearly 30%. As noted, we have written previously about the Trump Legislative Agenda, the TCJA and the “scorecard” measuring both the agenda and the law. This report must be regarded as good news for those that pointed to the Tax Act as a way to repatriate American dollars taken offshore.

Further, more US corporate investments has stayed home. A corollary is that the U.S. direct investment abroad position, or cumulative level of investment, decreased $62.3 billion to $5.95 trillion at the end of 2018 from $6.01 trillion at the end of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The decrease reflected a $75.8 billion decrease in the position in Latin America and Other Western Hemisphere, primarily in Bermuda. By industry, holding company affiliates owned by U.S. manufacturers accounted for most of the decrease. (Source: Bureau of Economic Analysis report dated March 27, 2019)